May 2018 is indicated with the adoption of the General Data Protection Regulation or simply GDPR. The multiple strict policies and regulations for compliance have added weight to the already existing list of regulations that financial institutions must follow. This all became a real challenge for companies in the financial industry.

This article covered everything you need to know about GDPR compliance for financial firms, its impact on financial organizations, and how to comply with this regulation effortlessly.

What is GDPR?

The General Data Protection Regulation is an EU law on data privacy that aims at protecting the personal data of EU residents when dealing with companies located outside the European Union.

On the contrary, if your business is located within the EU, instead of GDPR, the EU law and Regulation #45/2001 are applied. However, GDPR service requires all the Unions' legal acts to be consistent with GDPR regarding data privacy.

To put it simply, GDPR states how and when the personal data of users can be collected and processed. No matter what industry you are operating in.

If we speak about the main highlights of the GDPR, here we can list the following:

- In case of any data breach, companies have 72h to report them;

- You need to adopt privacy-by-design principles for all your operations and technologies;

- To process any personal data, you need to receive explicit consent from a user;

- There are cases when you need to hire a Data Protection Officer to deal with regulations;

- You should have a record of all the processing actions;

- Be sure to implement severe financial data security standards and measures for possible privacy risks;

- It would be best to ensure both your customers' and employees' rights to delete personal data;

- All international transfers must comply with particular requirements.

GDPR and Financial Services

So, what did GDPR for financial services bring to banks, financial institutions, and payment service providers (or PSPs)?

Overall, implementing GDPR for banking and financial services means strict requirements and regulations on how to inform data subjects, provide portability rights, and timely issue data breaches.

According to the GDPR for financial institutions, PSP is treated as the data processor and the merchant as the data controller, while the customer and cardholder are the data subjects. Customer data, together with their card data, is personal data under GDPR. The payment service processor must deal with customers' credit cards and different online payment methods selected by customers to release funds to merchants.

Any financial institution needs to comply with GDPR as well as other laws (for example, AML Act for anti-money laundering). What is more, all financial services, along with payment processing firms, are subject to GDPR penalties. Such penalties include damages made to the data subject, administrative fines, and reprimands.

For example, if we speak of the financial sector, in 2021, the Spanish data protection authority fined Caixabank $7.3 million for the misuse of personal data and consent failures under GDPR.

Does the GDPR Apply to Companies in Financial Services?

Even before the appearance of the GDPR, companies were operating in accordance with a strict culture of compliance in financial institutions. They also had a risk management framework that ensured that privacy and data protection were safe. However, it was challenging as you have tons of users' data to manage.

GDPR for financial institutions requires financial institutions to stay proactive when dealing with compliance. To speak about the finance organizations located in non-EU countries and operating in the EU market, they must understand all the regulatory provisions and the impact GDPR has on their operations.

Today, data collection and management for the financial sector requires more innovative and automated ways of using technologies. And all these technologies must be GDPR-compliant.

One of the main requirements of the GDPR is to communicate private information to customers. That is why companies must tell customers about all the data they collect, explain why they need it, and what they are going to do with it. However, that is mainly what financial companies have been doing for years, so those are easy to fulfill for them, unlike non-financial organizations.

Impact on the Financial Industry Under GDPR

To stay GDPR-compliant, financial institutions must employ the necessary system to securely get, track, and manage the sensitive data of EU citizens. Moreover, all the customer's sensitive data, being a part of the financial data, is the private data of the data subjects that have security requirements stated by GDPR. Thus, robust cybersecurity measures must also be in place.

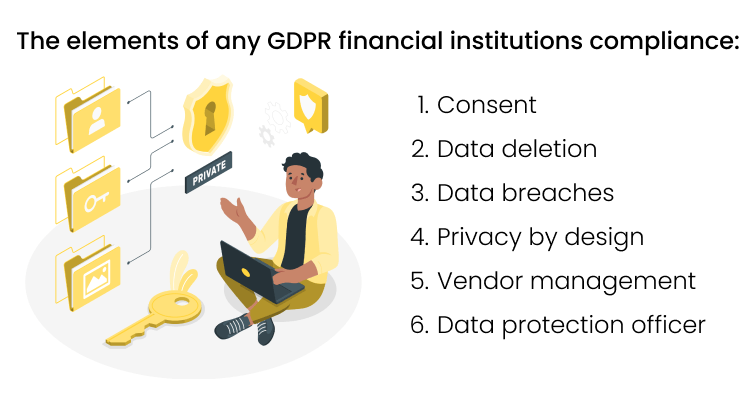

Financial companies must inform them and deal with requests regarding personal data by this system. Among the must-have elements of any GDPR financial institutions compliance are:

Consent

GDPR defines customer consent as 'genuine choice and control.' All the responsibilities for getting consent are placed upon a company. This means that you need to ask for the user's consent before collecting their personal data. Besides, it would help if you recorded how, when, and what was told about the consent to each user. Again, the user can ask for the withdrawal of their consent whenever they want.

Data deletion

Under the GDPR, each person has the right to ask for the erase of their sensitive data by a bank or any other financial institution. Even the data that a financial company has shared with any other third-party company. That is why all financial companies must employ reliable data inventories and tracking in place to fast and efficiently remove users' sensitive data upon request.

Data breaches

GDPR severely fines when there is a data breach. And by a data breach, they mean any case of a security breach that leads to the destruction, alteration, loss, access, or disclosure of a user's personal data. In case of such a breach, you have only 72 hours to inform the regulator about it.

Privacy by design

According to this point of GDPR for financial institutions, data protection must be the foundation of any business policy, operation, or project. This also means that the company is fully responsible for compliance and data protection and shows exactly how they are compliant, not just reporting. If not, you can be fined 4% of the global revenue or €20 million (whichever is greater).

Vendor management

As for many other sectors, data is the foundation of any financial organization and is shared through many apps and software solutions. That is why creating a robust and transparent process of how external vendors must deal with customers' data is vital.

Data protection officer (DPO)

If a financial organization deals with large silos of private data, most likely, it will be required to hire a DPO. Their primary responsibilities will include the following:

- creating and managing data protection policies and activities;

- giving recommendations and assessments on how to improve data protection measures;

- training staff;

- giving internal audits.

Complying with GDPR and Other Financial Regulations

Undoubtedly, there are multiple GDPR requirements that must be implemented by financial organizations over a short period of time. Yes, it is challenging to do everything manually. However, with an automated solution, that would become a piece of cake.

Today, you can find numerous solutions to help your financial company stay GDPR-compliant. For example, if you use the Zendesk help desk, you can try the GDPR Compliance app. This handy solution has all the necessary features to keep your customers' data safe:

- Remove all the user's personal data while keeping valuable insights about the person. Plus, create a unique ID to identify a user.

- No tedious manual work. Automatically download all the needed information about your customers and tickets in a CSV file.

- Entirely delete users' data and tickets from your Zendesk in just several clicks.

- Effortlessly edit individual or group data by creating lists with numerous filters.

- If you opt for premium access, you can schedule the date you want to delete the user's data or anonymize tickets pertaining to a particular user. You can also customize your own automation rules and choose what best suits you.

- You can delete not only users with the help of the GDPR Compliance app but the whole organization as well. In simple words, delete them individually or in bulk.